arizona solar tax credit 2019

Arizona Renewable and Solar Energy Incentives. Arizona solar tax credit.

Solar Is Now Cheapest Electricity In History Confirms Iea

To claim this credit you must also complete Arizona Form.

. Enter Zip - Get Qualified Instantly. You can only claim up to 1000 per calendar year on your state taxes. Check Solar Incentives Compare Quotes.

Dont miss out on the 30 Solar Incentive Tax Credit. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Solar panels are exempt from Arizonas 56 sales tax which means.

Get Qualified in Minutes. The federal solar tax credit gives you a dollar-for-dollar. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

The credit is allowed against. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

Talk to the experts at PEP Solar and well give you a free demonstration. Renewable Energy Production Tax Credit. 23 rows Did you install solar panels on your house.

Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022. The credit amount allowed against the taxpayers personal income tax is.

Check Rebates Incentives. The tax credit remains at 30 percent. Individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona.

Income tax credits are equal to 30 or 35 of the investment amount. Equipment and property tax exemptions Thanks to the Solar Equipment Sales. Arizona has the Arizona Solar Tax Credit.

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Get Qualified in Minutes. Provide heating provide cooling produce electrical power produce mechanical power provide solar daylighting or.

25 of the gross system cost up to a maximum of 1000. Arizona Department of Revenue tax credit. The federal residential solar energy credit is a tax credit that can be.

6 The maximum credit in. Arizona solar tax credit 2019 Monday March 21 2022 Edit. It is a 25 tax credit on product and installation for both 2020 through 2023.

There is no maximum amount that can be. 1 Best answer. June 6 2019 1029 AM.

30 for systems placed in service by 12312019 Expired 26 for systems placed in service after 12312019 and before. Arizona is a leading state in the national solar power and renewable energy initiative. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year.

Arizona solar tax credit 2019 Monday March 21 2022 Edit. The state sales tax of 56 does not apply to solar. Ad Calculate Your Cost To Go Solar.

This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Make the best out of 2019. Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Provide any combination of the above by means of. Ad Calculate Your Cost To Go Solar.

Check Solar Incentives Compare Quotes. Arizona will give a business a tax credit for 10 of the system cost up to 25000 for any one building in the same year and 50000 per business in total credits in one year. In 2019 the maximum credit allowed for single.

In addition to Arizonas solar incentives youll be eligible for the federal solar tax credit if you buy your own home solar system outright. Arizona Residential Solar and Wind Energy Systems Tax Credit. Enter Zip - Get Qualified Instantly.

Currently the credit amount is as follows. This incentive is an Arizona personal tax credit. Here are the specifics.

Solar energy systems in Arizona get a tax credit equivalent to 25 of their value or 1000 whichever is less. Check Rebates Incentives. Favorable laws rebates property and sales tax.

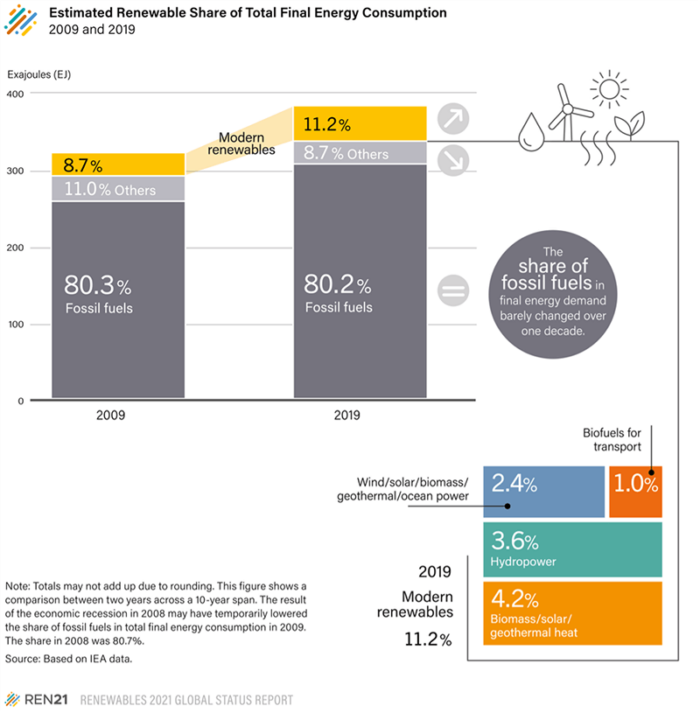

The Future Of Renewable Energy Storage Post Covid In North America For 2021

Solar Is Now Cheapest Electricity In History Confirms Iea

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

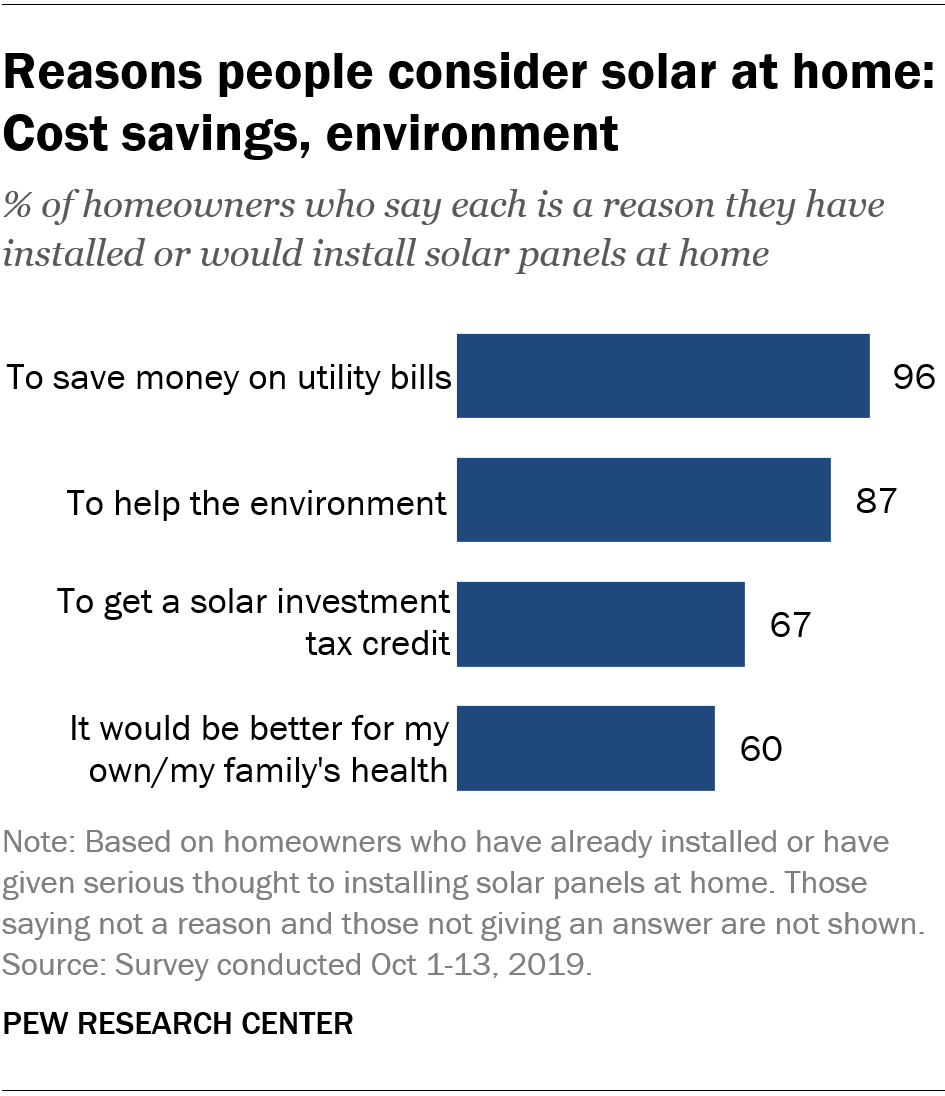

More U S Homeowners Say They Are Considering Home Solar Panels Pew Research Center

Everything You Need To Know About The Solar Tax Credit Palmetto

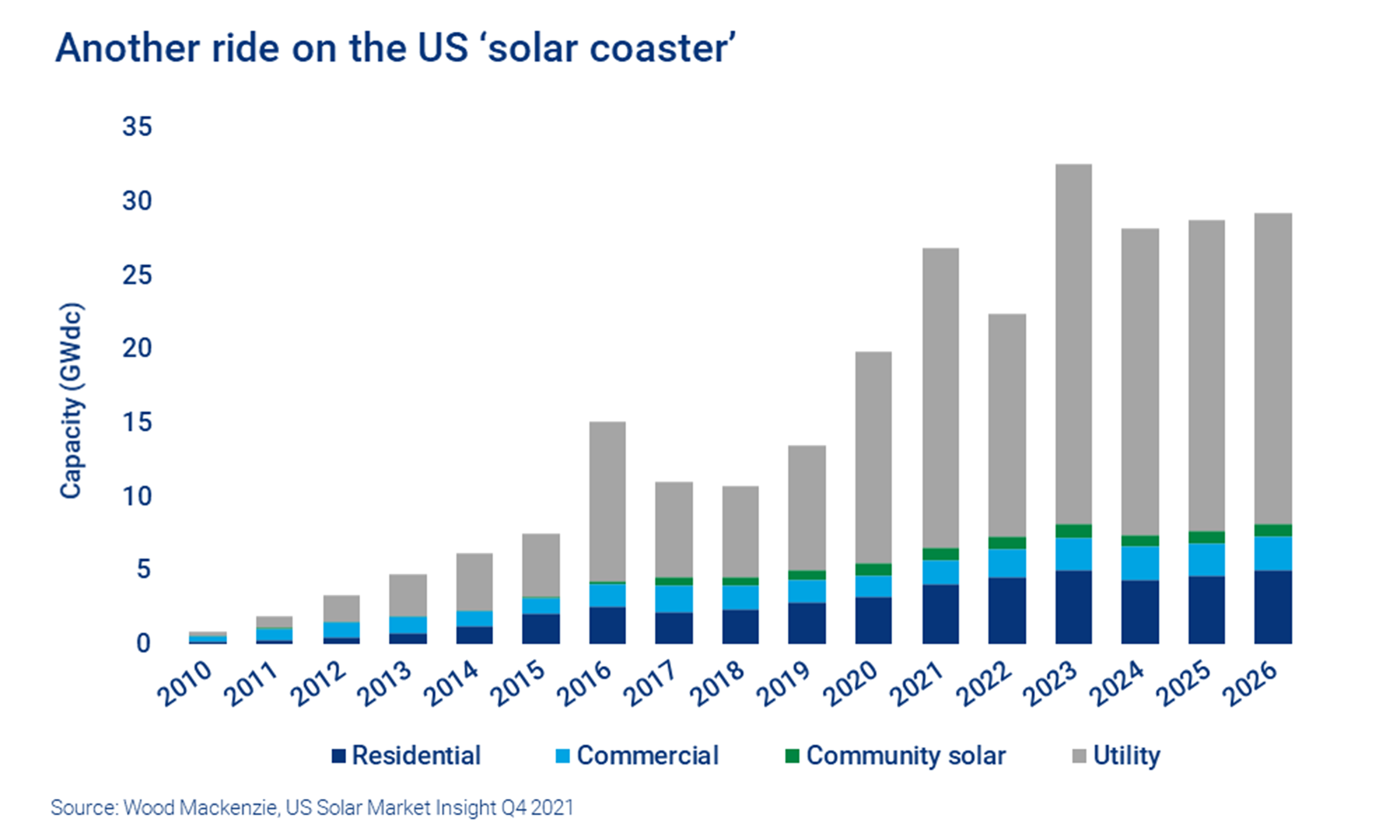

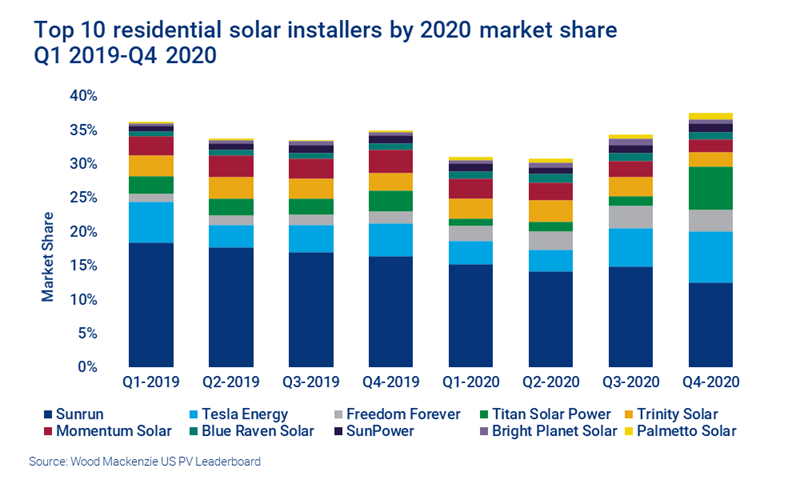

Redefining The Us Solar Coaster Wood Mackenzie

The Future Of Renewable Energy Storage Post Covid In North America For 2021

Energy Design Rating Energy Consulting Energy Energy Services

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

Fun Free Things To Do Near Me With Kids Archives United States Map Usa Map Territories Of The United States

Asteroid Bennu S Features To Be Named After Mythical Birds Osiris Rex Mission Mythical Birds Solar System Images Nasa

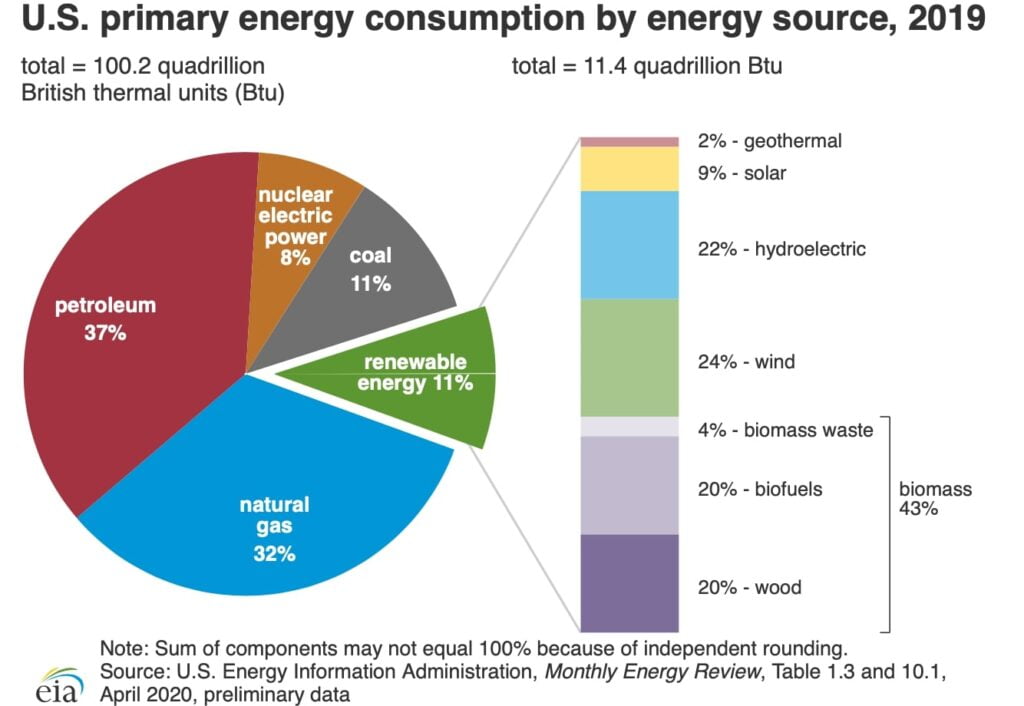

Eia Annual Energy Outlook 2020 Issue In Focus U S Energy Information Administration Eia

The Extended 26 Solar Tax Credit Critical Factors To Know

Universo Magico La Galaxia Del Triangulo Space And Astronomy Earth From Space Space Pictures

2019 Electric Utility Residential Customer Satisfaction Study J D Power

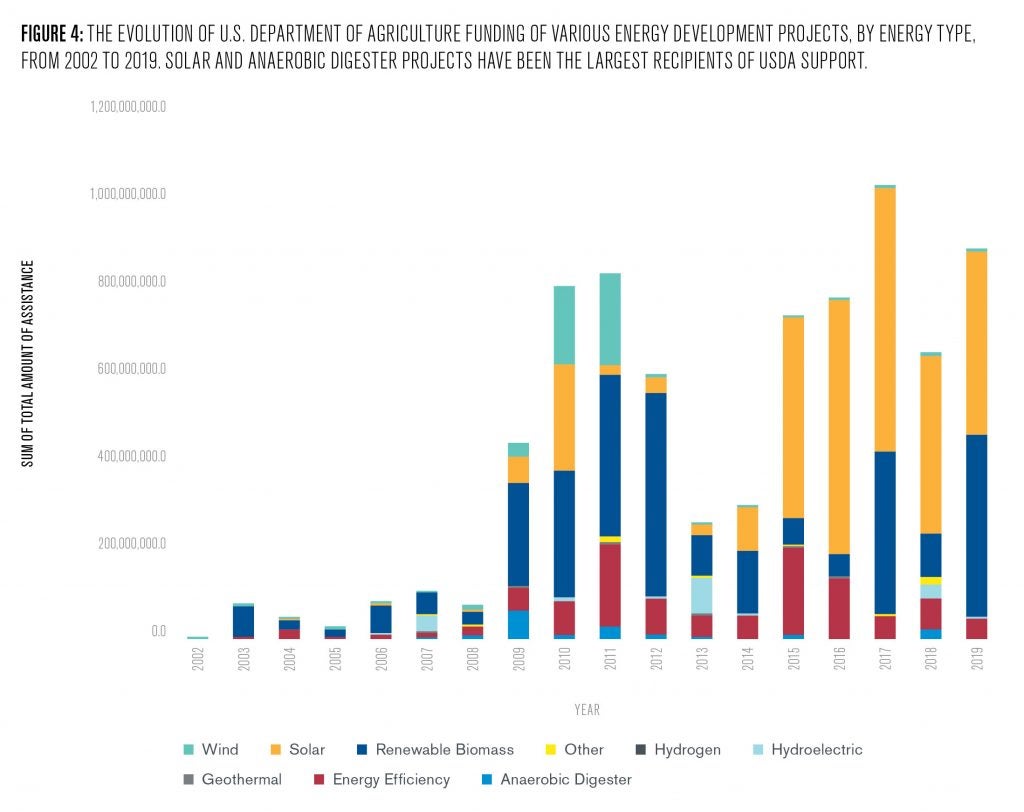

Harvesting The Sun On Farm Opportunities And Challenges For Solar Development Kleinman Center For Energy Policy

Eia Annual Energy Outlook 2020 Issue In Focus U S Energy Information Administration Eia

How Does Your State Make Electricity The New York Times

Where And When To See The May 20 Solar Eclipse Eclipse Photos Solar Eclipses Solar Eclipse